KFA Value Line Dynamic Dividend Equity Index ETF

Доходность за полгода: 3.05%

Отрасль: Large Cap Value Equities

Сравнение ETF

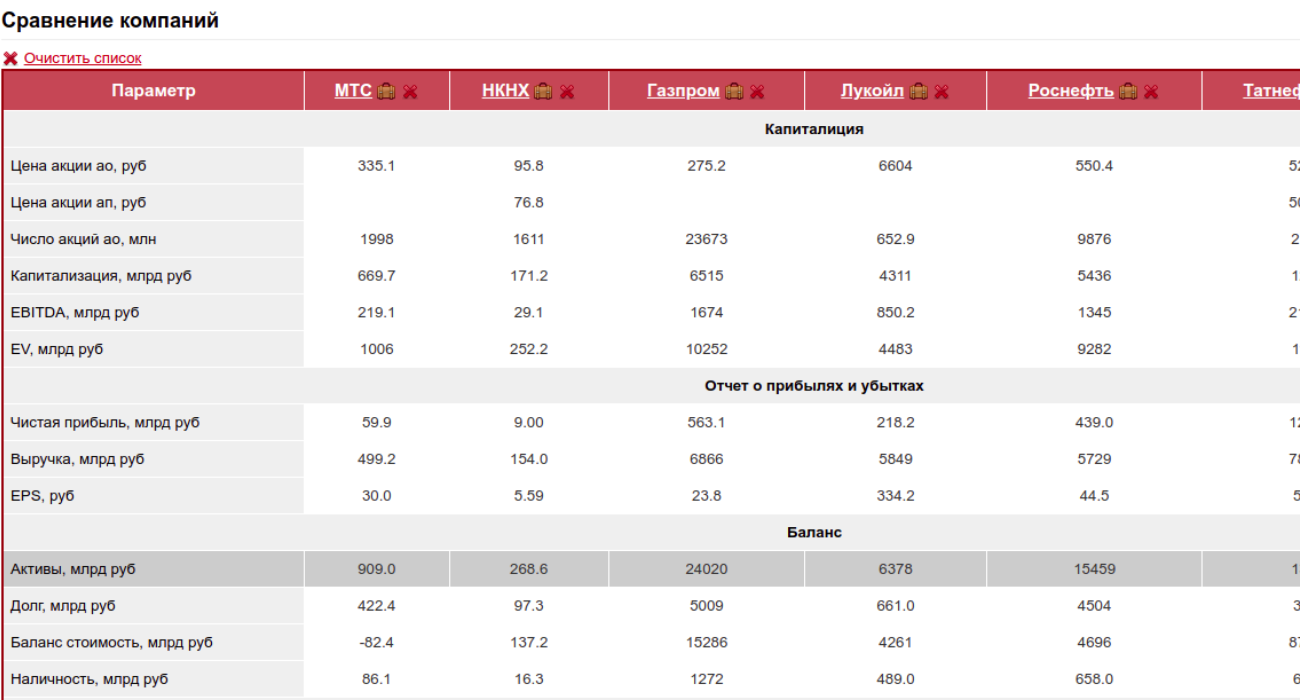

Очистить список| Параметр | KFA Value Line Dynamic Dividend Equity Index ETF | iShares MSCI USA Value Factor ETF | iShares Core High Dividend ETF | iShares Global Infrastructure ETF | First Trust Morningstar Dividend Leaders Index Fund | ALPS Sector Dividend Dogs ETF |

|---|---|---|---|---|---|---|

| Активы | 32000000000 | 6947000000 | 10342000000 | 3536000000 | 3857000000 | 1112000000 |

| Цена | 24.46 | 103.24 | 108.19 | 48.68 | 37.68 | 52.44 |

| Годовая доходность | 0 | 41.01 | 20.07 | 21.84 | 31.04 | 39.99 |

| 3 летняя доходность | 0 | 27.84 | 21.75 | 20.79 | 30.92 | 28.24 |

| 5 летняя доходность | 81.40 | 42.52 | 33.92 | 50.37 | 52.63 | |

| Комиссия | 0.56 | 0.15 | 0.08 | 0.41 | 0.45 | 0.36 |

| Дивиденды | 2.58 | 2.52 | 3.48 | 3.61 | 4.43 | 4.21 |

| Средний P/E | 0.05 | 10.72 | 12.34 | 21.48 | 11.46 | 0.07 |

| Число бумаг в ETF | 71 | 150 | 77 | 75 | 101 | 52 |

| Категория | Large Cap Value Equities | Large Cap Value Equities | Large Cap Value Equities | Large Cap Value Equities | Large Cap Value Equities | Large Cap Value Equities |

График цены

KFA Value Line Dynamic Dividend Equity Index ETF

Простой график

Расширенный график

iShares MSCI USA Value Factor ETF

Простой график

Расширенный график

iShares Core High Dividend ETF

Простой график

Расширенный график

iShares Global Infrastructure ETF

Простой график

Расширенный график

First Trust Morningstar Dividend Leaders Index Fund

Простой график

Расширенный график

ALPS Sector Dividend Dogs ETF

Простой график

Расширенный график