iShares US Equity Factor ETF

Доходность за полгода: 8.88%

Отрасль: Large Cap Blend Equities

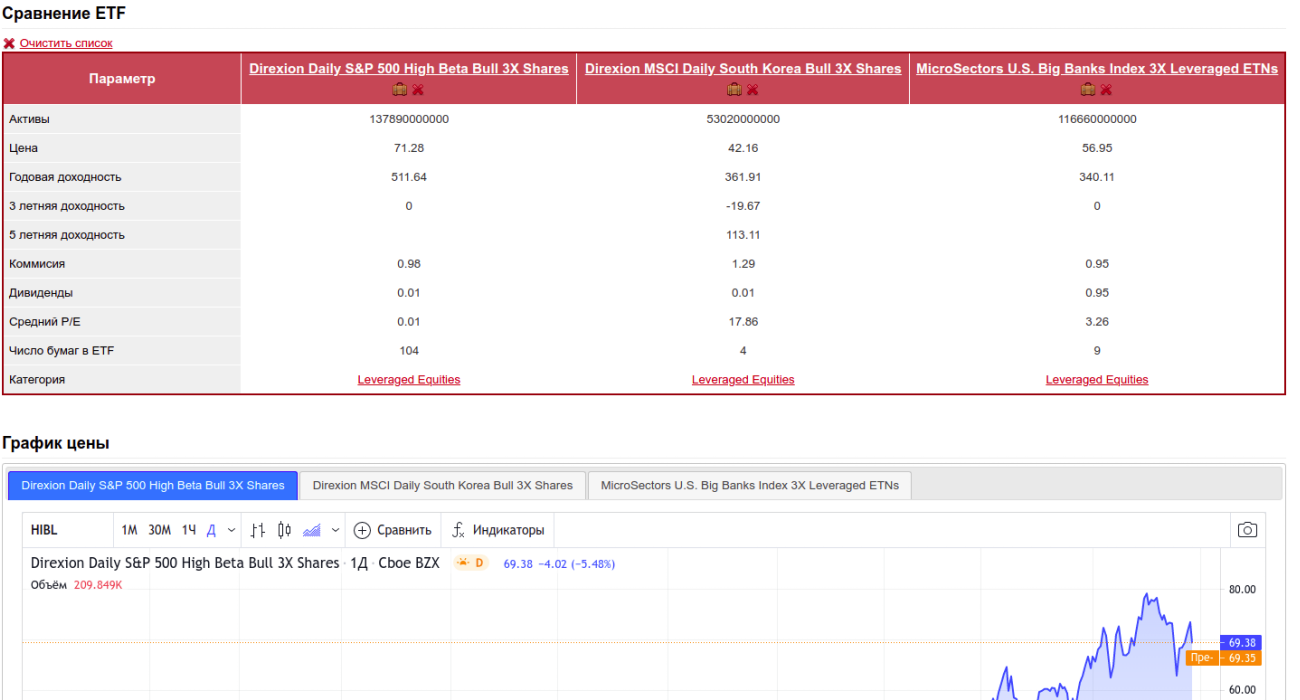

Сравнение ETF

Очистить список

Очистить список

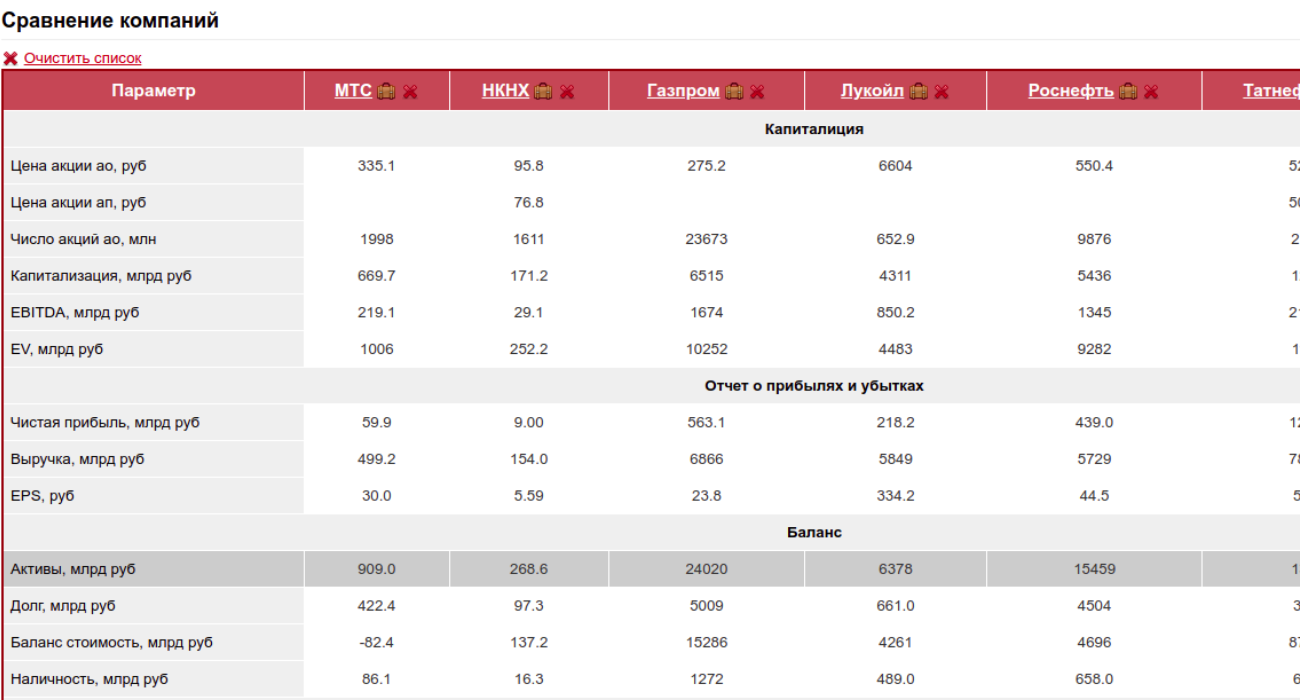

| Параметр |

iShares US Equity Factor ETF

|

Vanguard Value ETF

|

iShares Russell 1000 Value ETF

|

Vanguard High Dividend Yield Index ETF

|

iShares S&P 500 Value ETF

|

Invesco S&P 500® Equal Weight ETF

|

|---|---|---|---|---|---|---|

| Активы | 2013000000 | 117745000000 | 55464000000 | 53750000000 | 32620000000 | 53954000000 |

| Цена | 56.28 | 160.47 | 174.05 | 118.87 | 181.52 | 163.75 |

| Годовая доходность | 33.61 | 34.69 | 35.78 | 32.05 | 32.86 | 41.79 |

| 3 летняя доходность | 42.71 | 38.64 | 37.88 | 35.25 | 39.93 | 54.65 |

| 5 летняя доходность | 97.97 | 83.44 | 72.32 | 72.18 | 77.44 | 103.57 |

| Комиссия | 0.08 | 0.04 | 0.19 | 0.06 | 0.18 | 0.20 |

| Дивиденды | 1.27 | 2.37 | 1.97 | 3.01 | 1.84 | 1.18 |

| Средний P/E | 16.51 | 15.80 | 14.89 | 14.80 | 18.40 | 16.14 |

| Число бумаг в ETF | 152 | 353 | 843 | 413 | 434 | 506 |

| Категория | Large Cap Blend Equities | Large Cap Blend Equities | Large Cap Blend Equities | Large Cap Blend Equities | Large Cap Blend Equities | Large Cap Blend Equities |

График цены

iShares US Equity Factor ETF

Простой график

Расширенный график

Vanguard Value ETF

Простой график

Расширенный график

iShares Russell 1000 Value ETF

Простой график

Расширенный график

Vanguard High Dividend Yield Index ETF

Простой график

Расширенный график

iShares S&P 500 Value ETF

Простой график

Расширенный график

Invesco S&P 500® Equal Weight ETF

Простой график

Расширенный график