Nationwide Dow Jones Risk-Managed Income ETF

Доходность за полгода: 4.85%

Отрасль: Volatility Hedged Equity

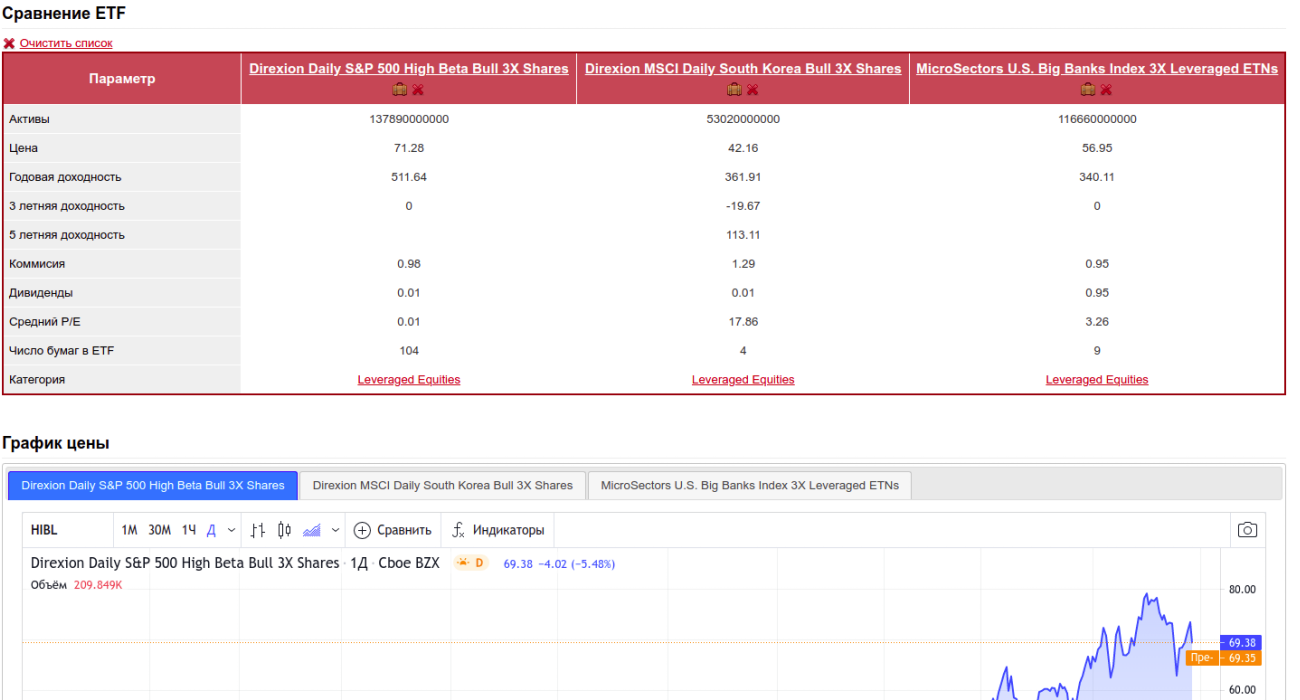

Сравнение ETF

Очистить список

Очистить список

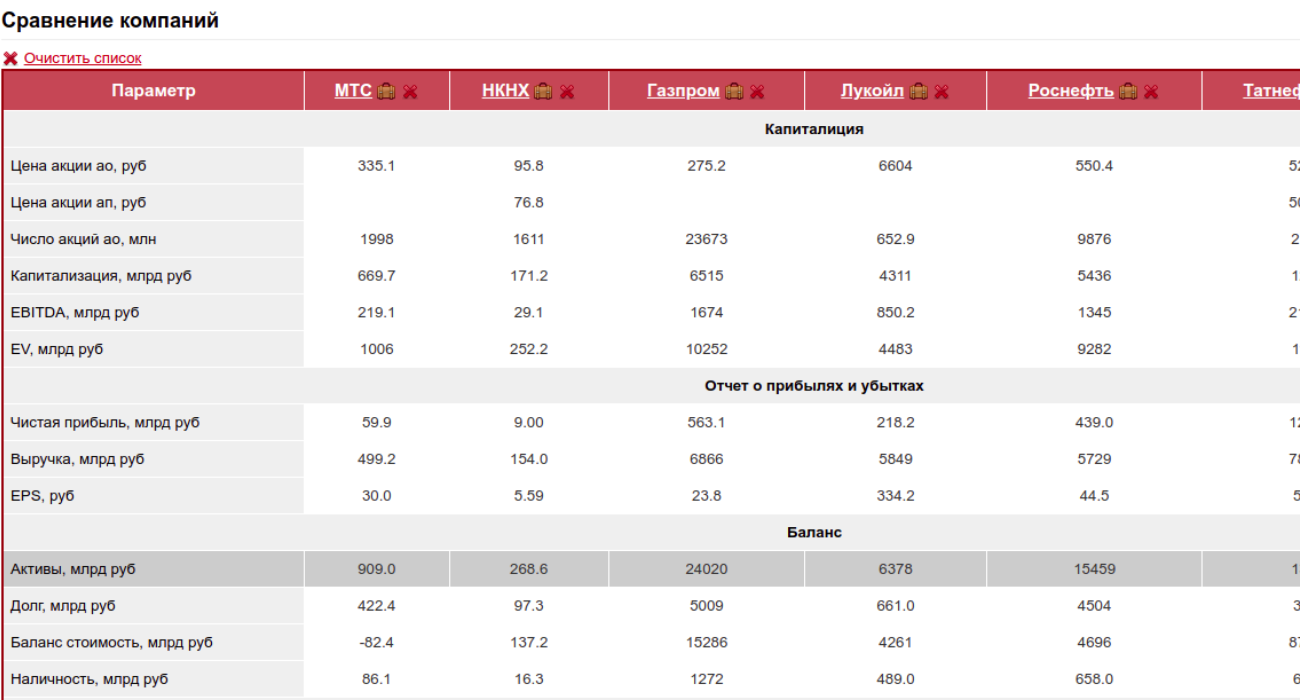

| Параметр |

Nationwide Dow Jones Risk-Managed Income ETF

|

Invesco S&P 500® Low Volatility ETF

|

Invesco S&P 500® High Dividend Low Volatility ETF

|

Invesco S&P MidCap Low Volatility ETF

|

Invesco S&P SmallCap Low Volatility ETF

|

Invesco S&P International Developed Low Volatility ETF

|

|---|---|---|---|---|---|---|

| Активы | 19000000000 | 6973000000 | 2923000000 | 772000000000 | 323000000000 | 387000000000 |

| Цена | 21.42 | 64.74 | 44.1 | 54.85 | 43.55 | 27.5 |

| Годовая доходность | 0 | 19.87 | 35.73 | 28.3 | 40.36 | 14.75 |

| 3 летняя доходность | 0 | 37.65 | 21.37 | 20.36 | 3.56 | 9.95 |

| 5 летняя доходность | 70.50 | 39.36 | 55.95 | 41.25 | 26.51 | |

| Комиссия | 0.68 | 0.25 | 0.30 | 0.25 | 0.25 | 0.25 |

| Дивиденды | 6.63 | 2.28 | 4.24 | 2.23 | 2.24 | 3.28 |

| Средний P/E | 3.57 | 19.23 | 13.30 | 17.77 | 16.43 | 16.04 |

| Число бумаг в ETF | 101 | 51 | 81 | 121 | 202 | |

| Категория | Volatility Hedged Equity | Volatility Hedged Equity | Volatility Hedged Equity | Volatility Hedged Equity | Volatility Hedged Equity | Volatility Hedged Equity |

График цены

Nationwide Dow Jones Risk-Managed Income ETF

Простой графикРасширенный график

Invesco S&P 500® Low Volatility ETF

Простой графикРасширенный график

Invesco S&P 500® High Dividend Low Volatility ETF

Простой графикРасширенный график

Invesco S&P MidCap Low Volatility ETF

Простой графикРасширенный график

Invesco S&P SmallCap Low Volatility ETF

Простой графикРасширенный график

Invesco S&P International Developed Low Volatility ETF

Топ 15 эмитентов ETF

Авторизуйтесь или войдите с помощью:

При добавлении компаний в список сравнения можно сравнивать по разным параметрам

Авторизуйтесь или войдите с помощью:

Telegram

Telegram