SP Funds S&P 500 Sharia Industry Exclusions ETF

Доходность за полгода: 12.03%

Отрасль: Large Cap Growth Equities

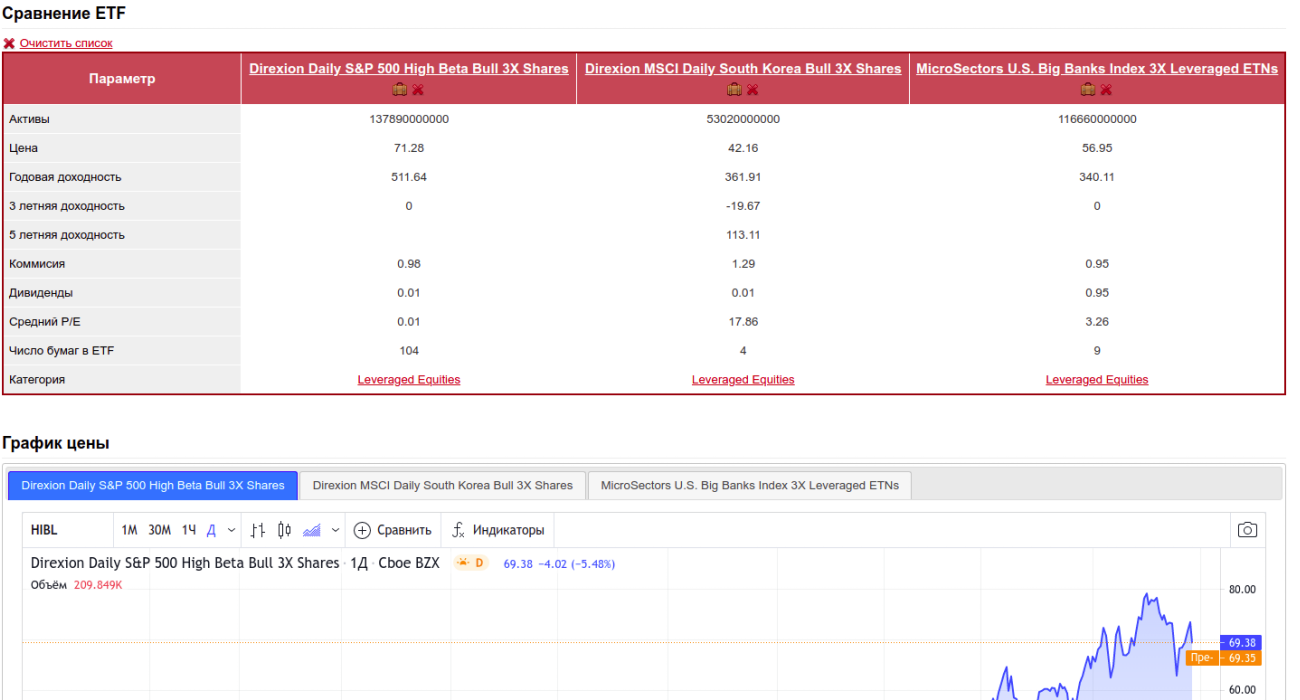

Сравнение ETF

Очистить список

Очистить список

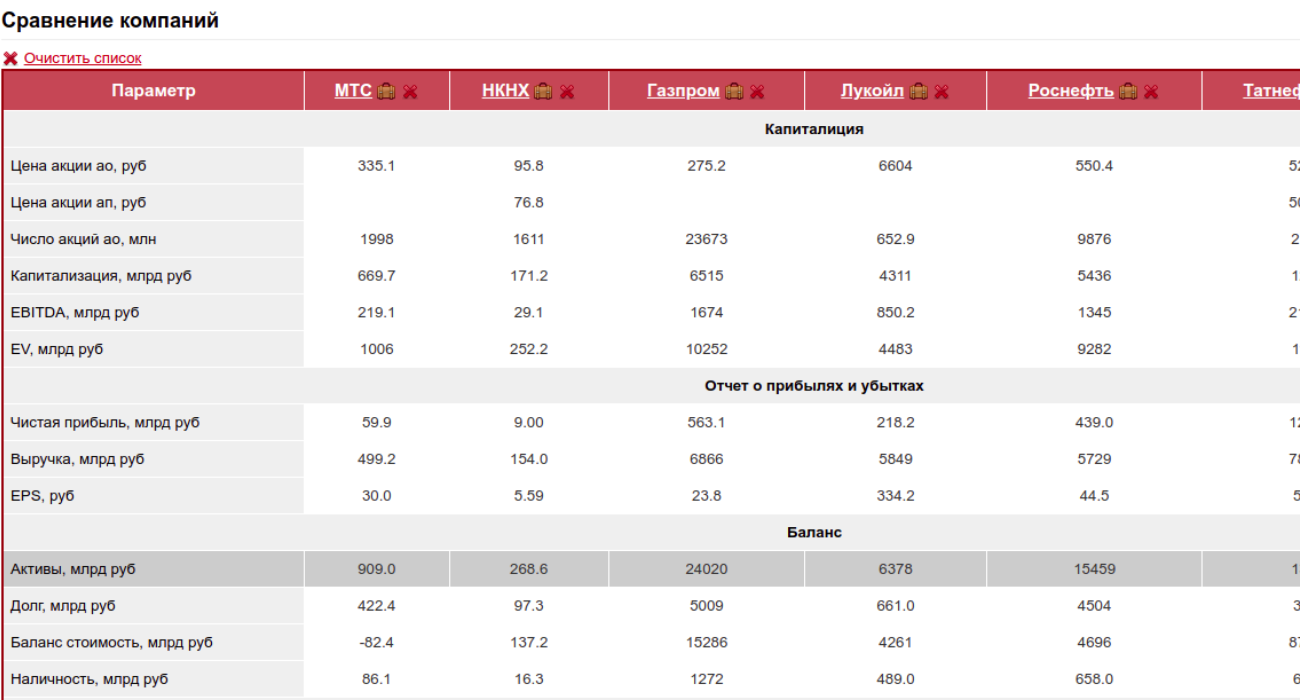

| Параметр |

SP Funds S&P 500 Sharia Industry Exclusions ETF

|

SPDR S&P 500 ETF Trust

|

iShares Core S&P 500 ETF

|

Vanguard S&P 500 ETF

|

Invesco QQQ Trust Series I

|

Vanguard Growth ETF

|

|---|---|---|---|---|---|---|

| Активы | 636000000000 | 547519000000 | 494118000000 | 474812000000 | 289428000000 | 135341000000 |

| Цена | 41.25 | 551.46 | 554.33 | 506.81 | 491.04 | 382.77 |

| Годовая доходность | 29.22 | 30.04 | 38.92 | 30.2 | 27.62 | 27.48 |

| 3 летняя доходность | 0 | 64.28 | 65.42 | 64.65 | 108.52 | 97.01 |

| 5 летняя доходность | 128.04 | 123.86 | 128.86 | 240.42 | 190.10 | |

| Комиссия | 0.45 | 0.09 | 0.03 | 0.03 | 0.20 | 0.04 |

| Дивиденды | 0.73 | 1.25 | 1.31 | 1.32 | 0.59 | 0.50 |

| Средний P/E | 0.03 | 17.86 | 19.66 | 20.10 | 22.70 | 28.80 |

| Число бумаг в ETF | 203 | 507 | 507 | 508 | 103 | 289 |

| Категория | Large Cap Growth Equities | Large Cap Growth Equities | Large Cap Growth Equities | Large Cap Growth Equities | Large Cap Growth Equities | Large Cap Growth Equities |

График цены

SP Funds S&P 500 Sharia Industry Exclusions ETF

Простой график

Расширенный график

SPDR S&P 500 ETF Trust

Простой график

Расширенный график

iShares Core S&P 500 ETF

Простой график

Расширенный график

Vanguard S&P 500 ETF

Простой график

Расширенный график

Invesco QQQ Trust Series I

Простой график

Расширенный график

Vanguard Growth ETF

Простой график

Расширенный график